新入荷再入荷

【廃盤モデル】ジリオンtw 1516 xxh ダイワ

タイムセール

タイムセール

終了まで

00

00

00

999円以上お買上げで送料無料(※)

999円以上お買上げで代引き手数料無料

999円以上お買上げで代引き手数料無料

通販と店舗では販売価格や税表示が異なる場合がございます。また店頭ではすでに品切れの場合もございます。予めご了承ください。

商品詳細情報

| 管理番号 | 新品 :04014216 | 発売日 | 2024/07/23 | 定価 | 22,000円 | 型番 | 04014216 | ||

|---|---|---|---|---|---|---|---|---|---|

| カテゴリ | |||||||||

【廃盤モデル】ジリオンtw 1516 xxh ダイワ

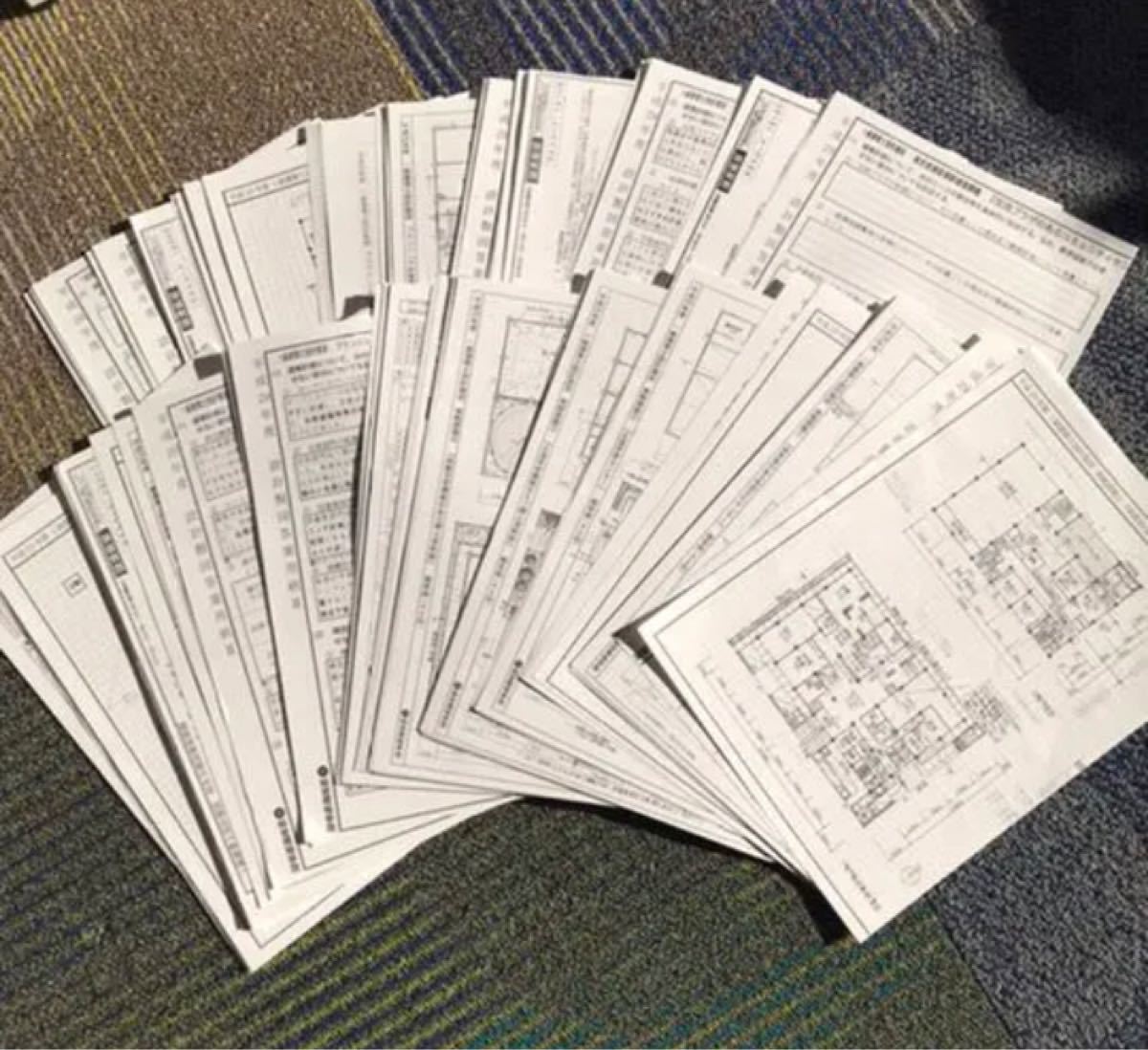

DAIWA Zillion tw 1516xxhダイワ ジリオンtw 1516xxh廃盤となったジリオン1516シリーズの一巻きメーター超え、超ハイギアモデルです。★使用状況3ヶ月ほど前に釣具屋のOLストアで未使用品を購入。約10回程度使用。河口、サーフ、河川中·上流域★商品状態ボディ表面に使用に伴う傷(画像参照)先週内部パーツクリーニング、グリスアップを行い、その後一度使用(使用後は水道水洗浄済み)ラインは1,5号200m(不要であれば抜きます。)★出品理由左巻きに矯正するため★その他上記はすべて素人評価であることをご了承いただける方のみご購入お願い致します。基本的にこちらからの値下げは行わないため、何かありましたらお気軽にコメント下さいませ!#ジリオン#ベイト#ベイトシーバス#シーバス#ベイトサーフ#ビッグベイト#ビッグベイトシーバス#ダイワ#スティーズ#タトゥーラ商品の情報カテゴリー : スポーツ・レジャー > フィッシング > ロッドブランド : ダイワ商品の状態 : やや傷や汚れあり発送元の地域 : 神奈川県